Once you give a discount, there is no way back without losing something. The logic for the customer is clear: if you could give that discount before, why can’t you give it again now? Then you give more discounts driven by cheaper products from your competitors flooding the market. Finally, your customer discovers that another customer has an even greater discount, and you don’t have an explanation for that. Your price leakage is now out of control!

Have you experienced that before? Unfortunately, this scenario is extremely common, but there is a way to bring your pricing management under control again. In this article, you will find tips on how to improve your capacity to maximize your profits.

Let’s now analyze together some pricing areas that commonly have the potential to stop your profit leakage:

1. Approval process for discounts

2. Discount policy compensations

1. Approval process for discounts

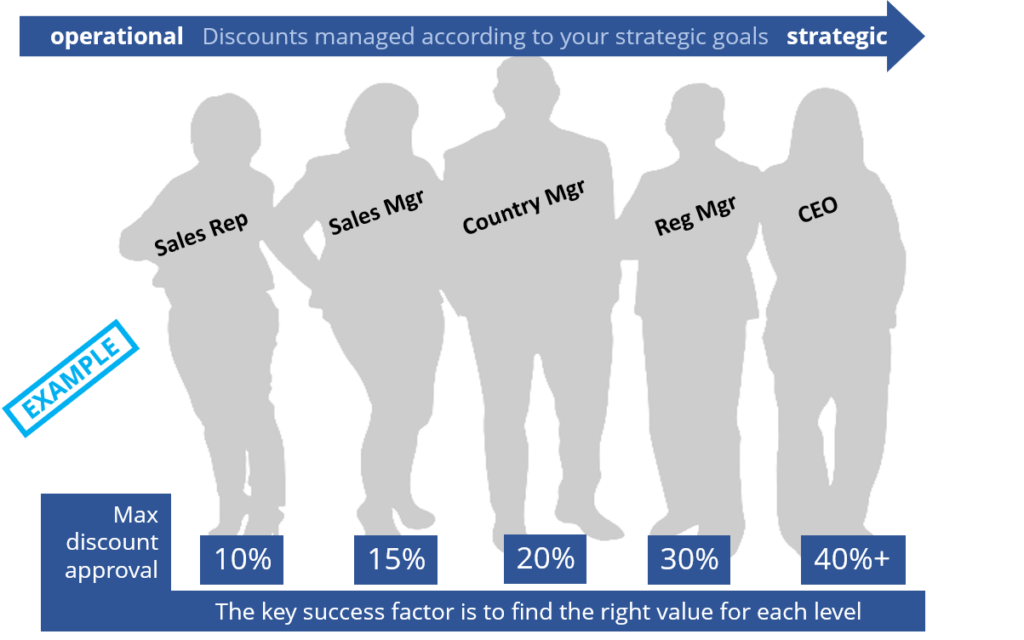

First of all, pricing must not be one person’s responsibility. Both responsibility and accountability should be shared across the company so that you only give high discounts as a strategic decision. “Yes,” said a head of sales, “we have an approval process, but only for large customers and major deals.”

“For small customers and minor deals, we do not have this capacity”. Sometime later, a large customer had bought a very small one. Surprise! For years, this small customer had been granted a considerable number of discounts while it was flying under the radar. The big customer then asked for compensation for its losses. This referred to all future discounts as well as accumulated deals made over the last 5 years. Would you like to be in that situation? Well, the losses were so significant that the head of sales had to pay several times the investment which would have been required to implement a comprehensive pricing approval management system.

This company understood, given this traumatic experience, that there is a sizeable benefit from increasing, or at least protecting its profits when a fair and clear discount approval process is in place. Here’s the trick, the sales teams should have enough freedom to operate according to pricing and discount policy, while management should support the sales teams in more strategic decisions when the level of discounts gets out of a specified range. There is more good news. The pricing approval process is usually not so complex to implement once you already have a CRM with a Quotation and Order Management system in place.

2. Discount policy compensations

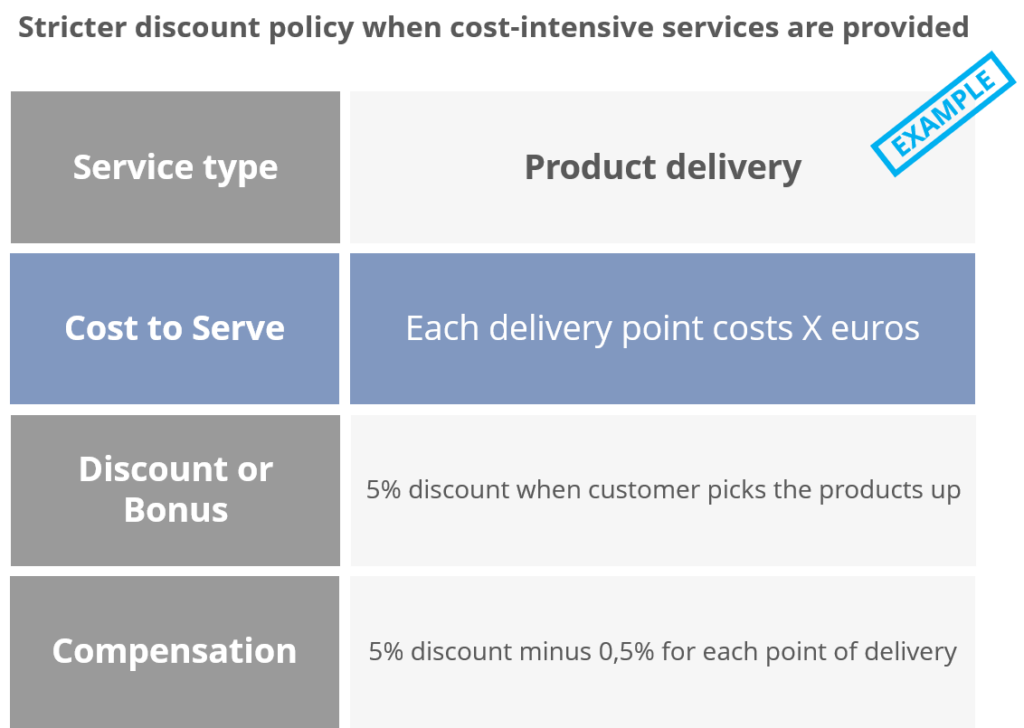

“Discounts should be avoided to keep our profitability!” Do you agree with this statement? Well, this is generally true, but there is a way to give more discounts and increase your profitability at the same time. Take a look at your costs to serve your customers, such as freight, delivery time, volume, and payment terms. Here I am using the manufacturing industry as an example.

Are you giving those “services” to your customers free of charge? For example, do you charge extra if you have to deliver to more than one destination, if you have to deliver very quickly, if the volume does not completely fill a container, if the volume does not match your production batch or if the customer delays payment?

For manufacturing companies, those logistics, production, and financial costs could be massive and kill your dream to achieve your target profit.

Customers have different needs with respect to your services. While some of them have complex freight needs, others would be glad with more discounts instead of full freight services. Some would require that you have a safety stock to avoid discontinuity of their operations, others would prefer to pay less accepting longer delivery times.

What do you think will happen, if you give a 5% discount to all customers who pick up their orders themselves? What usually happens is that many customers who have better logistical options, such as using their own transportation resources that might not be at full capacity, will get the discount and will collect the products themselves. Of course, you calculated beforehand that this 5% discount would equate to less than your delivery costs. Great, you have just improved your profitability!

And what do you think will happen if you give a 5% discount to all customers who accept 21 days or more between placing the order and receiving the products? Obviously, many customers who made use of your quick delivery generosity before and placed orders last-minute will now organize themselves better to get the discount. In this case, you will have the chance to manufacture the items specifically for this customer, without incurring warehouse costs. You have again improved your profitability, without creating any conflict with your customer, in fact, some of them will achieve more advantageous pricing without incurring any extra costs.

Everybody is better-off and both you and your customers make more money – it is a happy end for everyone. Don’t you think? The end is happy, but the beginning is scary. This is the reason so many companies are not doing it, or at least not doing it consistently. It is easier to implement than you think. For a start, you just need the right methodology to calculate and analyze your costs to serve and the level of discounts you should grant. By doing that, you will discover how big your profit leakage actually is. Very importantly, this methodology is not just for manufacturing, it also applies to the service areas. I challenge you now: Start analyzing your costs to serve and see how much you are giving to your customers for free!

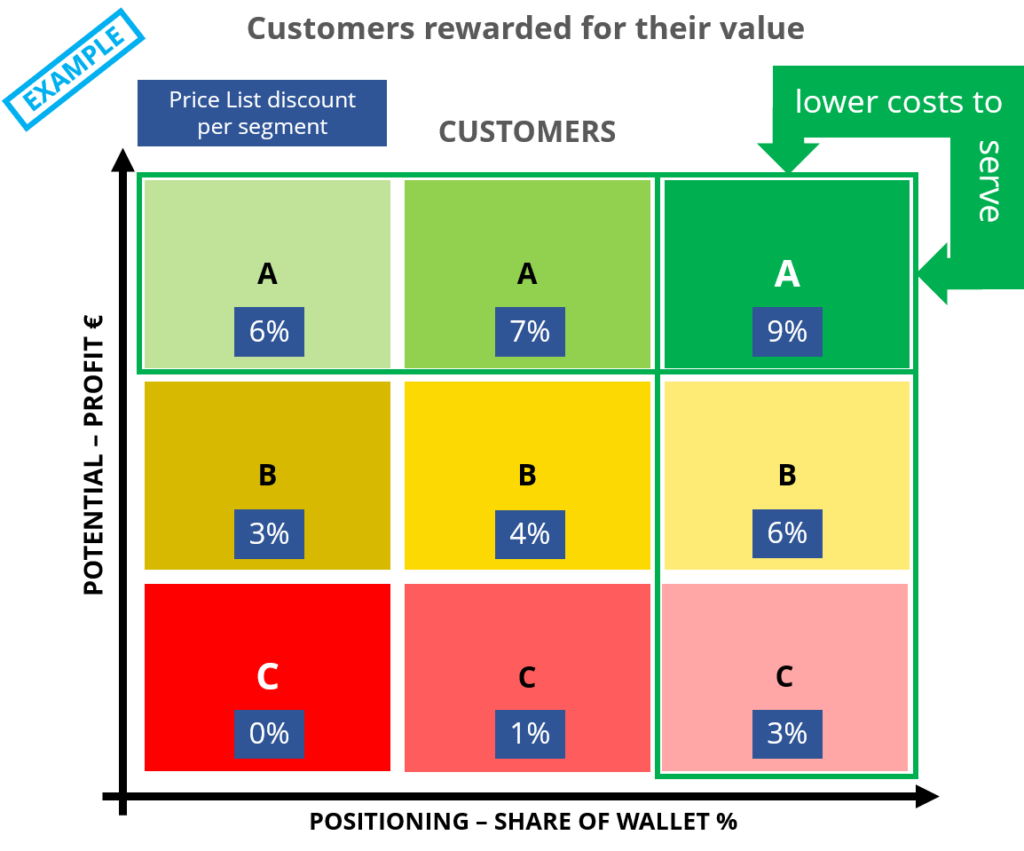

3. Customer value pricing

Another head of sales once said: “I cannot give the same price to every customer!” Correct, and you really shouldn’t do that in most Business-to-Business situations. Treating your customers with a similar pricing approach is usually inefficient and can lead to one of these 2 outcomes:

A) Underpricing your products and decreasing your profitability.

B) Overpricing your products and reducing your turnover potential or even losing customers.

That is why the price adaptation to your customers’ potential is vital to leveraging your sales performance. Naturally, this cannot work without clear and fair logic. If a customer asks you why the other one is getting higher discounts, you need to be able to answer: “You can also have the same discounts if you do X, Y, and Z.“

First, you have analyzed, via customer segmentation, the potential profit that the customers could bring to you in the next 3 years. You have also calculated (in some cases estimated) how much of this potential the customer will dedicate to you instead of your competitors. There we go! The customers with the greatest potential and additionally those who give you a substantial share of their wallet will get the biggest base discount (base discount: a discount given before you apply your normal discount policy). The other customers with less potential, who give you less share of their wallet, will get less from the base discount. You inform your customers that they start with a price X% less than the others because they are of big value to you. If other customers complain, no problem, you just explain that if they order the same volume and dedicate the same share of their wallet, they will get the same level of discount.

Remember, usually customers who acquire a larger volume and give you a significant share of their wallet cost you less to serve them. Therefore, when you give this X% base discount, you are not losing anything, and are usually even gaining a bit of margin because the X% discount is compensated by the lower cost to serve. Everybody is happy again! Your most valuable customers get more discounts than anyone else, and you make more profit with these customers than any other in your portfolio.

The great majority of companies have the potential to improve their profits when they apply best practices in pricing and increase pricing monitoring via reports and dashboards. Think about that! In a competitive market and in the middle of a crisis, in which increasing prices is sometimes a faraway dream, the suggestions in this article could provide the chance you need to achieve your target profits or at least avoid that all your efforts leak to the floor and are therefore wasted.

It is also very important to realize that the 3 suggested areas create discipline and structured processes in your pricing activities. This is a key step if you want to digitalize your selling process.

Contact KRAEMER to support you in the further development of your capacity to maximize your profits.

Caio Kraemer is a professional with more than 10 years of practical experience implementing and managing Sales Excellence projects in Germany and globally. His 25 years of experience extend to several industries, market structures, consumable and durable goods. The success of his projects is based on passion, pragmatism, know-how, perseverance and change management.

© KRAEMER Sales Excellence Consulting GmbH